Configure Wisely

%

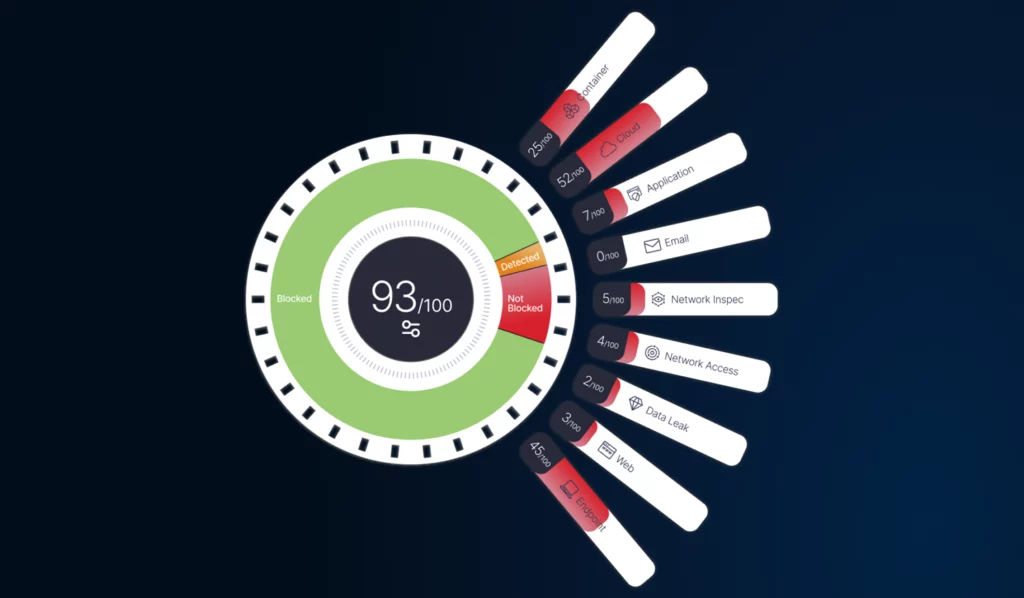

Protection-Coverage Improvement

Operate Efficiently

%

Savings on Red Team Exercises

Risk Less

%

Risk-Posture Reduction

Discover the SafeBreach Difference

Fastest Time to Value

We are the only BAS company offering high touch support, training and services, allowing you to optimize your threat management program and get results 24x faster.

Redefining Actionable Intelligence

Our world-renowned research team actively ensures SafeBreach has coverage for relevant attacks. We’ve built the largest attack playbook, backed by a 24-hr SLA for adding newly identified attacks from US-CERT and critical alerts.

The Only True Enterprise Ready Platform

From out of the box scenarios to customization, we offer the speed, scale and stability to support you through business transformation.

Resources to Help You Plan For the Unknown

Because you don’t know what you don’t know. Until you do.

“We use SafeBreach inside PayPal to gain a continuous, measurable, and complete view of our security posture. It helps keep PayPal safe every day as a key part of our continuous testing and assurance program.”

– Senior Director of Security, PayPal